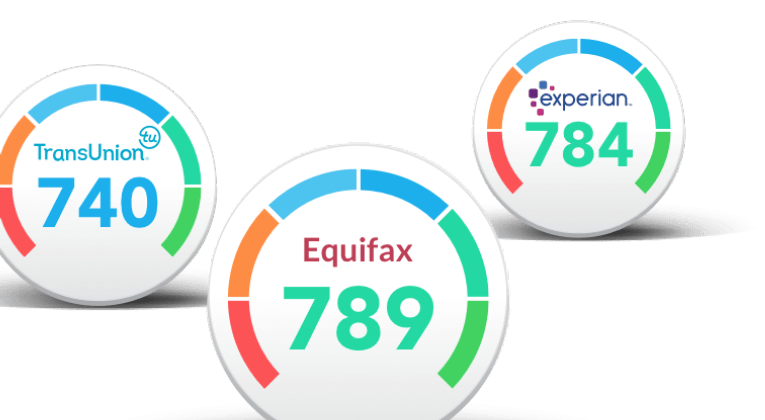

Get Your Credit Scores

From All 3 Bureaus as of

Mar 01, 2026

Checking your own credit won't hurt your scores.

A Complete View of Your Credit, Delivered in Seconds!

Rated 4 Stars on Google by ScoreSense Customers

What Our Customers Say About ScoreSense

Jane Smith

Excellent Service

“ScoreSense helped me understand and improve my credit. I highly recommend them!”

Michael Lee

Very Helpful

“Great team and support. I was able to dispute errors easily.”

Lisa Johnson

Love the Updates

“I appreciate the monthly updates — they give me peace of mind.”

As Seen On

Trusted by leading media & financial news outlets

Why ScoreSense?

We fill in the gaps that others simply don’t.

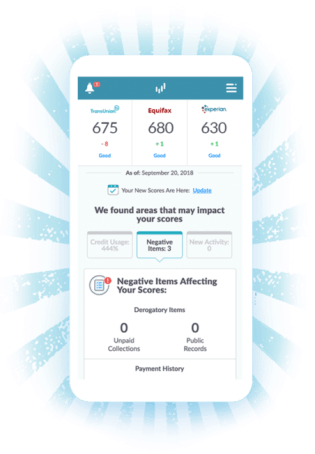

See what lenders may see

Monthly Updates to your 3 credit scores and reports from all 3 bureaus show you where you stand.

See what lenders may see

Monthly Updates to your 3 credit scores and reports from all 3 bureaus show you where you stand.

See what lenders may see

Monthly Updates to your 3 credit scores and reports from all 3 bureaus show you where you stand.

See what lenders may see

Monthly Updates to your 3 credit scores and reports from all 3 bureaus show you where you stand.

Get one-on-one help

Our credit specialists are here to help you make sense of your credit, every time you call or chat.

Your privacy is protected

All your information is protected with 128-bit encryption to ensure your data is not intercepted by third parties.